a specific market Index — like the Nifty 50 or Sensex in India.

— made simple for all levels.

Our Mission & Vision

Helping You Grow Your Money the Smart Way

At ETF Junction, our mission is to empower investors of all levels to build wealth confidently through low-cost, diversified, and transparent investment solutions. We believe in the long-term power of Index investing and ETFs as tools to simplify the path to financial freedom.

We are committed to delivering clear education, unbiased insights, and easy-to-use tools that help our users make informed decisions. By promoting disciplined, evidence-based investing, we aim to democratize access to financial growth and security—one portfolio at a time.

Why Choose Passive Investing?

A smarter, low-maintenance path to long-term wealth.

Low Fees

Passive funds have minimal management costs, helping you keep more of your returns.

Broad Diversification

Gain exposure to a wide range of sectors and companies through Index-based portfolios.

Consistent Performance

Track the overall market’s growth with stable, long-term returns that often outperform active funds.

Tax Efficiency

Fewer trades mean lower capital gains taxes and better after-tax performance.

Transparency

Know exactly what you own Index funds follow clear, published criteria.

Reduced Emotional Decisions

A rules-based approach helps avoid emotional trading mistakes during market ups and downs.

Key Metrics

Analyze Fund Performance

Dive into detailed performance metrics for various ETFs and Index funds. Our platform provides historical data, expense ratios, and other crucial indicators to help you make informed investment decisions. Compare funds side-by-side and identify the best options for your portfolio.

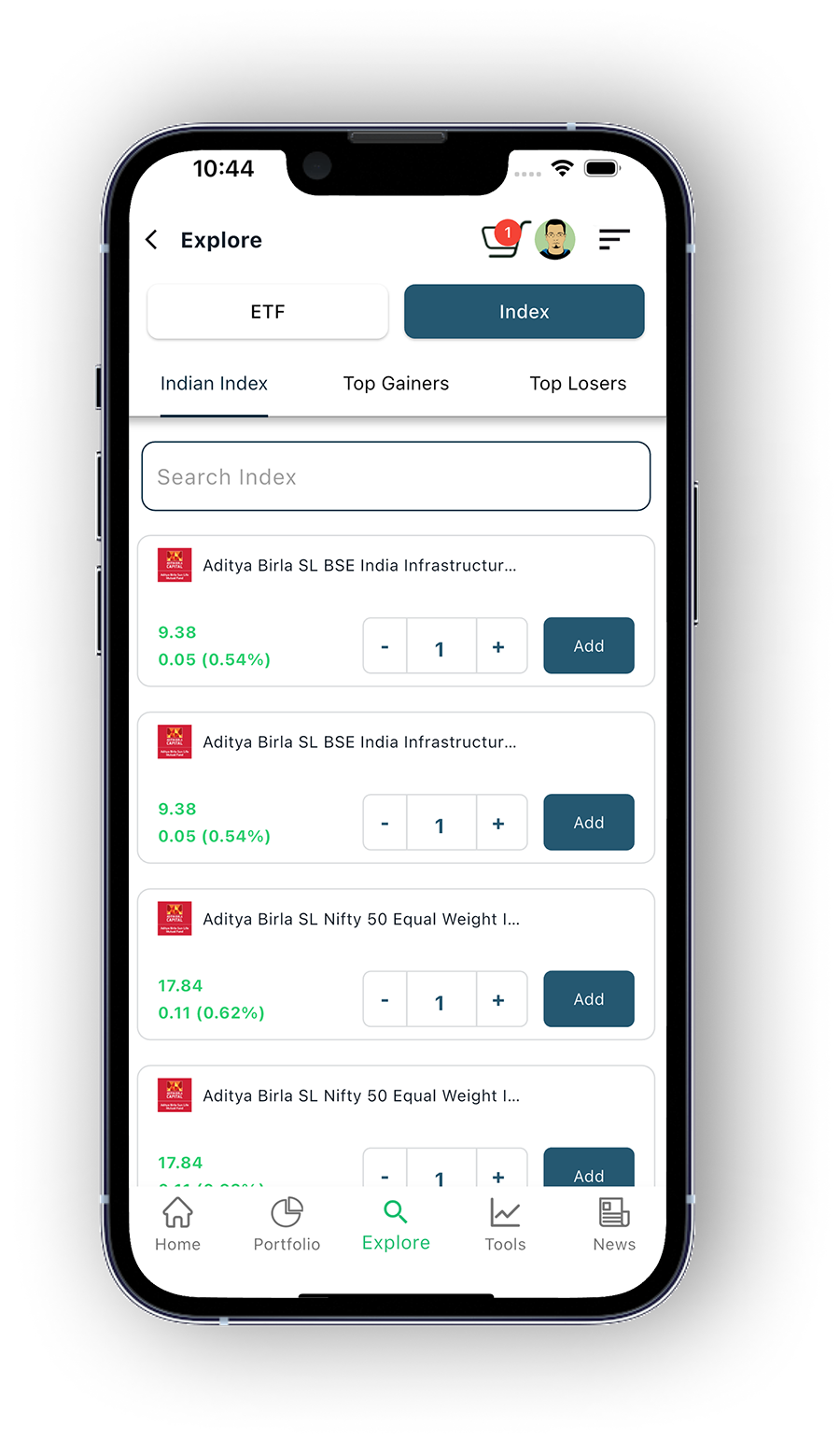

Compare ETFs/Index fundsFrequently Asked Questions(FAQs)

Do not hesitate to send us an email if you can’t find what you are looking for

ETF (Exchange-Traded Fund): An ETF is a type of fund that holds a collection of assets (stocks, bonds, commodities, etc.) and trades on an exchange like a stock. It is bought and sold throughout the day at market prices.

Index Fund: An Index fund is a type of mutual fund designed to track the performance of a specific market Index (like the S&P 500). Unlike ETFs, Index funds are not traded during the day; they are bought or sold at the end of the trading day at the NAV (Net Asset Value).

Both ETFs and Index funds are considered good for long-term investing because they generally have low fees and are diversified. However, the decision depends on your preferences:

- ETFs offer more flexibility due to intra-day trading and lower minimum investment requirements.

- Index funds may be preferable for long-term investors who don’t mind trading once a day and prefer a more hands-off approach.

Yes, there are tax implications:

- ETFs generally have more tax efficiency because they use an "in-kind" creation and redemption process, which helps avoid triggering capital gains taxes.

- Index funds, on the other hand, are subject to capital gains taxes when the fund manager buys or sells securities within the fund, which can lead to taxable distributions.

ETFs usually have lower expense ratios than Index funds, and they tend to be more cost-effective for investors who trade frequently.

Index funds might have slightly higher expense ratios and, in some cases, can have transaction fees for buying or selling, but they can still be a low-cost option for buy-and-hold investors.

The Global ETF Movement.

Influence people with your expert analysis, videos, posts, articles, and above all, your investment choices on ETF Tribe. Show your investing smarts by sharing your portfolio statistics with our ETF community.

Develop your brand and assert your dominance as an ETF Junction Influencer!