Understanding smart beta - the growing popularity of factors in investments

By Koel Ghosh , ETF Junction

Monday, February 26, 2024

So, what is smart beta? A commonly used term in investment strategies and recently more so in passive investment, may not be as easy a term for all to understand. The aim of this blog is to simplistically explain the term, its key characteristics and how its integrating into the investing strategies to benefit portfolio goals.

Smart Beta investing is also alternatively referred as factor investing. Beta can be simply explained as the variability or movement of the stock or portfolio in comparison to the benchmark. For e.g. If we consider the NIFTY 50 or the SENSEX30, the beta for those indices is 1.0 so any portfolio or index that has higher beta will be more than 1.0 and lower beta will be less than 1.0. This brings us to “smart” beta wherein in the strategies include factors such as quality factors, momentum, low volatility, growth, dividend yield, etc thereby altering the beta to vary from the benchmark.

In the Indian context explaining factor relevance in investment strategies to common Indian investors may have been a real challenge in the early 2000s. It was a concept that the financially astute audience was adept at as it had been commonly used in active investing wherein quantitative factors were incorporated into portfolios for stock selection.

In the passive space the first index mutual fund was introduced in 19751 First Index Investment Trust, now Vanguard 500 Index Fund, that tracked the S&P500 and it was not a smart beta passive product. The Invesco S&P 500 Equal Weight ETF was the first smart beta product launched in 20032.

The growth in passive investments has provided a segway for smart beta products. These rules-based strategies provided a factor tilt to offer options with alternative stock weightages thereby differentiating them from regular market benchmark beta exposures offering investors more options.

There are a wide range of factors that are used in such strategies, and they are differentiated depending whether the y are defensive or cyclical in nature. Factors such as quality, low volatility are defensive while momentum, value and size are cyclical. Cyclical is the opposite of defensive and

- David M. Smith and Hany A. Shawky. "Institutional Money Management: An Inside Look at Strategies, Practices, and Players," Page 36. John Wiley & Sons, 2011

- https://www.invesco.com/us/en/solutions/invesco-etfs/smart-beta-investing.html

- Frida Foreland and Pia Solheim Kreutz Do Smart Beta ETFs Outperform Work Market

hence the combination of the two at times is a strategy adopted by many portfolio managers to achieve an ideal balance.

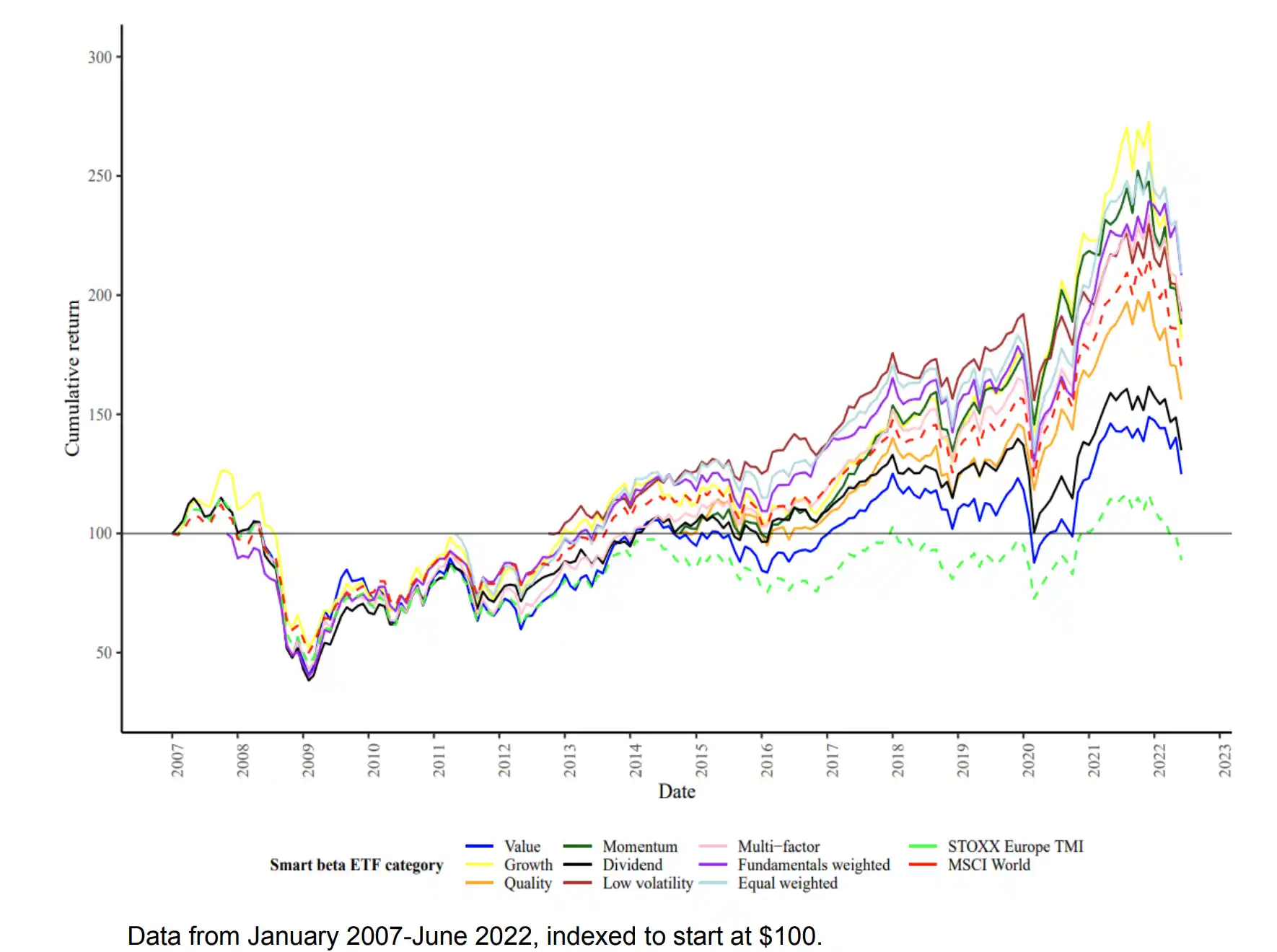

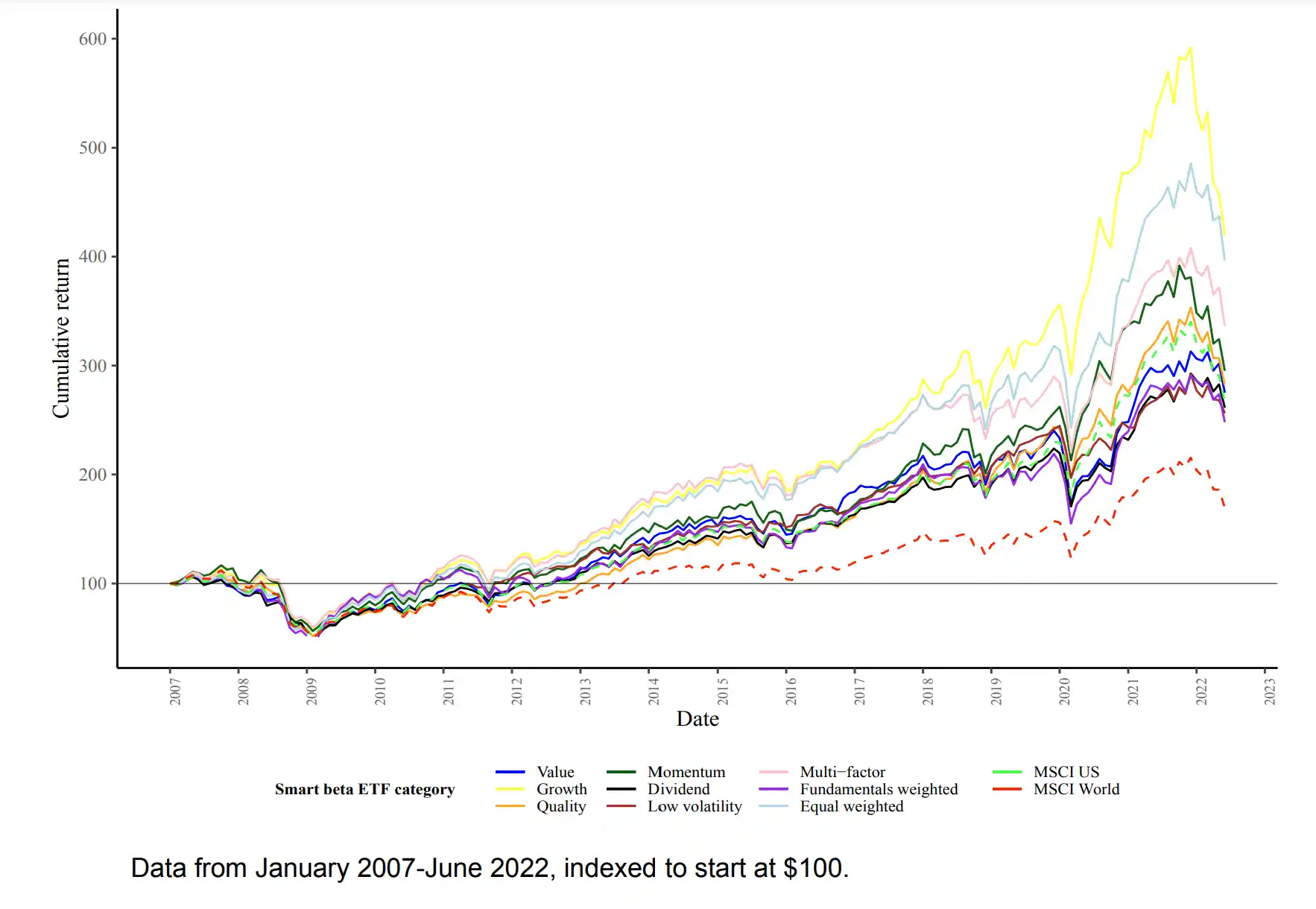

A study by the Norwegian School of Economics in their Paper “Do Smart Beta ETFs Outperform the World Market?”3 the students Frida Foreland and Pia Solheim Kreutz researched the performance trajectory of smart beta factors and their cumulative return trends. Their observations were that American markets smart beta factors had a higher return trajectory. The financial crisis affected all the factors in both regions but some factors like equal weight, growth have had similar return trends in both regions.

Cumulative total return for each smart beta ETF category portfolio in Europe

Cumulative total return for each smart beta ETF category portfolio in US

- David M. Smith and Hany A. Shawky. "Institutional Money Management: An Inside Look at Strategies, Practices, and Players," Page 36. John Wiley & Sons, 2011

- https://www.invesco.com/us/en/solutions/invesco-etfs/smart-beta-investing.html

- Frida Foreland and Pia Solheim Kreutz Do Smart Beta ETFs Outperform Work Market

In India, the smart beta landscape is building out with the growth in passive investments. The factors like equal weight, momentum, low volatility, quality and value are gaining popularity with new product launches creating more options for Indian investors to choose from.

Disclaimer: Mutual Fund Investments are subject to market risks. Read all scheme-related documents carefully.

You may also like:

Suggested blogs:

What does the commonly used acronym ETF mean and why are ETFs associated with the term passive investment?

Monday september 11, 2023

Read MoreWhy is Exchange traded funds the new buzz word and the relevance in a portfolio?

Monday september 11, 2023

Read MoreETFs: The Evolutionary Leap in Financial Instruments

Monday september 11, 2023

Read More